A wise man once said, “Let the poor breathe. Don’t suffocate them.” That’s why I’m checking on you all and asking, ‘Are y’all breathing fine?’ Because I’m not. Sadly, this is the reality for many Nigerians. The cost of living and daily expenses are flying through the roof while our income seems like it’s tied to the chair.

Five years ago, one could easily say ‘I’m not rich, I’m not poor; I’m just comfortable.’ Nowadays, what is comfortable? The comfortable have become poor and the poor have become poorer. Who will save us?

Unfortunately, no one is coming to save us at this time. We can only save ourselves by ourselves. With that in mind, let’s explore 5 ways you can weather these turbulent times of economic hardship.

And, no! These personal finance tips are not temporary solutions. Keep reading.

Pay Off Your Debt

Paying off debt is often a crucial step in building wealth. When you have debt, you’re paying interest to someone else instead of earning interest on your own money. And the longer you take to pay off your debt, the more interest you’ll end up paying.

One strategy for paying off debt is called the “debt snowball.” With this approach, you start by paying off your smallest debt first. Once that’s paid off, you take the money you were putting toward that debt and apply it to your next smallest debt. This allows you to pay off your debts one by one, building momentum as you go.

Another option for paying off debt is called the “debt avalanche.” With this approach, you start by paying off the debt with the highest interest rate first. Then you move on to the next-highest interest rate debt, and so on. This strategy can save you money on interest over time.

ALSO READ: How I’ve Hustled and Lost My House Rent Twice this Year: Mike Shares His Experience.

Have an Emergency Fund

Having an emergency fund is really important, and it’s something that everyone should consider. An emergency fund is a sum of money that you set aside for unexpected expenses, like car repairs or medical bills.

The general rule of thumb is to have 3-6 months of living expenses saved up in an emergency fund. An emergency fund is like a safety net for your finances. It can help you weather unexpected storms, like job loss or illness. Having an emergency fund can give you peace of mind and financial security.

And it can also help you avoid going into debt in the event of an emergency. It’s also important to keep your emergency fund in a liquid, easily accessible account, like a savings account or your Fusion wallet.

Live Within Your Means

This is probably the most obvious of all personal finance tips. Living within your means is a really important financial principle. It means spending less than you earn, and not going into debt to maintain a certain lifestyle. It’s all about being smart and disciplined with your money.

Living within your means can help you build wealth over time and avoid financial stress. There are a few different ways to start living within your means. The first step is to track your spending and create a budget. This will help you see where your money is going and make sure you’re not overspending.

Then, you can start cutting back on unnecessary expenses and making room in your budget for savings. Another key principle is to avoid lifestyle inflation, which is when you start spending more as your income increases. Instead, you should focus on saving and investing your extra money.

Have Additional Sources of Income

Having an additional source of income can be really helpful when it comes to living within your means. It can also help you reach your financial goals faster.

There are a lot of different ways to generate additional income, like starting a side hustle, investing in real estate, or even just selling off your unwanted items online. A side hustle is a great way to generate additional income. It’s basically a part-time job or business that you do in addition to your regular job.

There are a lot of different options when it comes to side hustles, from driving for a rideshare company to selling crafts online. The key is to find something that you’re passionate about and that can generate a decent income.

ALSO READ: How to Be Rich in Naira and Spirit: Investments and Nigerians.

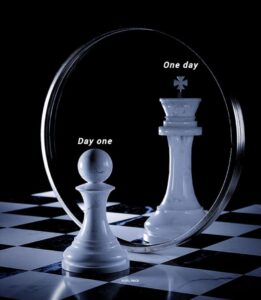

Invest With a Long-term Mindset

Investing for the long-term is one of the best ways to build wealth over time. The key is to invest in assets that have the potential to grow in value, like stocks, bonds, and real estate. It’s also important to start investing as early as possible, so your money has more time to grow.

An important aspect of investing for the long-term is diversification. This means spreading your money across a variety of different assets, so you’re not putting all your eggs in one basket. Diversification can help reduce risk and improve your chances of earning a good return.

Another important concept in investing is compounding. This is when the interest or profits from your investments are reinvested and generate even more interest or profits. Over time, this can lead to exponential growth. The key is to start investing early and consistently, so you can take advantage of compounding.

Frankly, none of these personal finance tips are new advice. You probably heard it 5 years ago but did nothing. Now you’re hearing it again. It’s not too late to start. By the end of the year, you’ll be so glad you did.

If you found this article useful, share it with someone else whom you think needs it just as much as you do. You should also join the Finance 101 community on Fusion for more tips, tricks, educational content and investment opportunities.

2,007 Responses

Aw, this was a very nice post. Taking a few minutes and actual effort to generate a good article… but what can I say… I put things off a whole lot and don’t seem to get nearly anything done.

https://spade77.org/melbet-bukmekerskaya-kontora-oficialniy-sayt-2025/

real canadian pharmacy https://edpillsafib.com/# cheap erection pills

Cor Pharmacy: Cor Pharmacy – CorPharmacy

1хБет промокод 2026 Новый промокод 2026 на https://www.weddingbee.com/members/bergkompressor/ позволяет получить бонус 100% до 32 500? для всех зарегистрированных пользователей.

поиск работы Удалённая работа для подростков: первые шаги в карьере. Подростки могут найти простые задания в интернете, такие как написание текстов, обработка фотографий или помощь в социальных сетях. Это отличный способ заработать первые деньги и получить опыт.

удаленная работа яндекс работа онлайн в контакте

https://corpharmacy.com/# canadian pharmacy levitra value pack