Only a few things have been able to get Nigerians down and Ponzi schemes are definitely one of them. They’ve been around for the longest time, bearing different names but the MO stays the same; always boasting outrageous returns within a short period of time with the claims of investing your money in some special investment vehicle for you meanwhile, all they are doing is taking your money and using it to pay previous members.

Any investment opportunity that doesn’t have a clear way to make money and success hinges on getting more people into the business is a Ponzi scheme, no matter how well packaged it is.

Guess what else is peculiar to Ponzi schemes, trauma! They’ll always dash your hopes and leave you stranded after milking you dry depending on how greedy you are.

I’ve always known there was something off about any business that promises quick (unrealistic) returns but that didn’t stop me from yielding to the pressure of submitting the better portion of my hard-earned NYSC allawee to register for one Ponzi scheme like that(can’t remember the name again), after much persuasion from one of my colleagues back in the day.

Till this day, i don’t know what became of my 6k. I genuinely feel for those people who used their children’s school fees, house rent, boss’ money, wedding funds or their colleagues’ salaries to join the bandwagon but you see that my 6k ehn, it really touched my bones.

You probably know that feeling..lol. Let’s do a trip down memory lane on some of the popular Ponzi schemes that left their marks on Nigerians and Nigeria’s financial landscape

MMM Nigeria

I’m sure most people would get upset, If this particular one doesn’t top my list because they really showed people shege. People literally lost their lives when this Ponzi scheme packed up because they were too invested in it. Their marketing strategy was one for the books. It was almost like jazz.

The Mavrodi Mundial Movement – fondly called MMM at the time, founded by the infamous Russian, Sergei Mavrodi, found its way to the Nigerian scene around 2016. It was the talk of the town. It promised participants a 30% monthly return on their investments.

Interestingly, the Government warned us but we didn’t listen. Thousands of Nigerians eagerly joined, hoping for quick riches. However, when the scheme collapsed, many lost their hard-earned money.

I can still remember that morning in December, it was as though a national tragedy had struck, people were devastated!

I’m not sure we’ll ever get an accurate estimate of how much Nigerians lost to this scheme. NDIC revealed that Nigerians lost N18 billion in the scheme. Some families are yet to recover from it.

Helping Hands

After MMM crashed, an avalanche of other Ponzi schemes poured into Nigeria, leveraging the situation to promote their agenda (almost as if someone blew a whistle inviting them).

You would expect Nigerians to have learnt their lessons from the recent experience but we carelessly jumped headlong into this pool again and got our fingers burnt.

Only this time, it was slow and steady. They even made us comfortable by fronting names of reputable organizations like Diamond Bank, Glo, HP, Hyundai, Apple…

Helping Hands came in the form of an empowerment programme that you had to register for with $40 (about N6600) at the time, and then invite at least two people to do the same.

Fulfilling these requirements automatically makes you a lifelong beneficiary of their “goodies” ranging from free skill acquisition to asset/property support (laptops, cars, i-pads), scholarships and financial support (income earning, loans and what not).

All these, without selling any product? Do the math, it doesn’t add up but we sha fell for it and the rest they say is history.

Twinkas

Twinkas was a money doubling venture that operated as a peer-to-peer donation platform and gained popularity after MMM crashed.

Its primary aim was to “improve people’s financial status” by facilitating financial empowerment among members.

Members had to pay a registration fee ranging from N20,000 to N100,000 and get ROI of 100-200% (depending on how much was invested) within 21 days.

These monies would be paid into specified personal accounts of two people the “system” pairs with you instead of a general central account.

I can still remember participants running around to ensure they made timely payments as people who delayed payments/defaulted were thrown out of the system.

All seemed well until Twinkas also vanished without a trace in the twinkling of an eye. Let’s not even talk about how much money people lost to this Ponzi scheme.

Yuan Dong Ponzi

I don’t know anyone who fell for this one personally but I heard about it at the time. Like the name suggests, Yuan Dong originated from China and promised astronomical returns through cryptocurrency trading.

It lured investors with the allure of exponential growth, telling people to invest between N10,000 to N240,000 with returns ranging from N80 to N2,400 on a daily basis.

Again, the government warned people but we were like; “no be you go tell us wetin we go do.” Unfortunately, the scheme crumbled, leaving countless Nigerians in financial ruin. The lesson here; beware of any investment promising unrealistically high profits.

Galaxy Transport

Gather here for a group hug if you were on this particular rollercoaster. Galaxy Transport presented itself as a logistics company offering investment opportunities.

It claimed to generate profits from transporting goods across Africa. Investors were promised substantial returns within a short period.

After giving people investor vibes, Galaxy Transport transported our funds to the galaxies without taking us there.

Staying Away from Ponzi Schemes

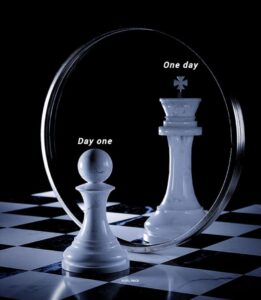

Truth is things were hard financially in the country at the time when these Ponzi schemes were thriving and people were just looking for a cheap means to make ends meet/earn more income. Hard times are here again but they won’t last forever.

The Ponzi schemes however keep evolving and trying their best to attract unsuspecting ambitious “investors” who just want to earn an income without doing much.

Please avoid these financial quicksands as they have nothing to offer but are looking to take away the little you have. Here are some tips to help you stay away from Ponzi Schemes

- Educate Yourself: Understand how legitimate investments work. If an opportunity seems too good to be true, it probably is.

- Check Credentials: Investigate the company and its founders. Verify their licenses and track record.

- Avoid Pressure: Ponzi schemes thrive on urgency. Don’t succumb to pressure; take your time to evaluate any investment.

- Diversify: Spread your investments across different assets. Diversification reduces risk.

- Report Suspected Schemes: If you encounter a suspicious investment, report it to the relevant authorities.

Remember, financial security comes from informed decisions, not get-rich-quick schemes. Stay vigilant, protect your hard-earned money, and avoid falling into the Ponzi trap. You can also see more on managing your finances properly here

Join our Finance 101 community on Fusion where we share tips, tricks and educational content on personal finance.

6,400 Responses

Your article helped me a lot, is there any more related content? Thanks!

EdPillsAfib: order ed pills online – EdPillsAfib

pharmacy online

safe canadian online pharmacies

drugstore online shopping

ViagraNewark: ViagraNewark – Viagra tablet online

canadian pharmacy store http://corpharmacy.com/# Cor Pharmacy

best mail order pharmacy canada: best online pharmacy – CorPharmacy

http://edpillsafib.com/# cheap ed meds

ViagraNewark Viagra Newark Viagra Newark

ed meds without doctor prescription https://viagranewark.xyz/# Viagra Newark

Cor Pharmacy: Cor Pharmacy – Cor Pharmacy

best online ed treatment: ed meds online – EdPillsAfib

canadian pharmacy online without prescription http://corpharmacy.com/# Cor Pharmacy

prescription cost comparison http://edpillsafib.com/# Ed Pills Afib

Viagra Newark: Viagra Newark – Viagra Newark

https://uofmsildenafil.xyz/# Uofm Sildenafil

Av Tadalafil: Av Tadalafil – tadalafil 5mg canada

buy tadalafil india where to buy tadalafil in singapore Av Tadalafil

http://massantibiotics.com/# antibiotic without presription

https://massantibiotics.com/# cheap zithromax pills

sildenafil otc canada: UofmSildenafil – Uofm Sildenafil

UofmSildenafil: Uofm Sildenafil – Uofm Sildenafil

https://massantibiotics.com/# MassAntibiotics

UofmSildenafil: Uofm Sildenafil – sildenafil rx

Uofm Sildenafil Uofm Sildenafil sildenafil price nz

PennIvermectin: how much ivermectin to give a goat – can you buy stromectol over the counter

Uofm Sildenafil: Uofm Sildenafil – Uofm Sildenafil

http://uofmsildenafil.com/# Uofm Sildenafil

http://massantibiotics.com/# Mass Antibiotics

http://pennivermectin.com/# PennIvermectin

https://pennivermectin.com/# PennIvermectin

Uofm Sildenafil Uofm Sildenafil sildenafil

AvTadalafil: AvTadalafil – tadalafil 20mg price in india

PennIvermectin: Penn Ivermectin – ivermectin for cats

http://pennivermectin.com/# ivermectin 8000

http://pennivermectin.com/# Penn Ivermectin

Av Tadalafil AvTadalafil buy tadalafil 20mg uk

Penn Ivermectin: ivermectin scabies buy online – Penn Ivermectin

PennIvermectin: ivermectin lice oral – stromectol 3 mg price

https://uofmsildenafil.com/# UofmSildenafil

https://pennivermectin.com/# Penn Ivermectin

http://uofmsildenafil.com/# UofmSildenafil

Av Tadalafil Av Tadalafil buy generic tadalafil online

where can i buy sildenafil: 200 mg sildenafil – UofmSildenafil

can we buy amoxcillin 500mg on ebay without prescription: MassAntibiotics – Over the counter antibiotics pills

http://avtadalafil.com/# tadalafil free shipping

MassAntibiotics: MassAntibiotics – buy antibiotics for uti

Penn Ivermectin Penn Ivermectin stromectol xl