Given the amount of losses Nigerians incurred during the Ponzi scheme era, you would expect us to have learnt the important lesson that all get-rich-quick schemes always end the same way; in premium tears.

However, the harsh economic conditions in the country have led people to seek alternative means of financial security. And once again, they have turned to a seemingly better get-rich-quick scheme as a replacement for the ponzi scheme — cryptocurrency.

I like to call it the “crypto craze;” offering Nigerians a “legitimate” way to generate income, but with its own set of risks and opportunities.

The Rise of Cryptocurrency in Nigeria

Cryptocurrency has quickly captured the imagination of many Nigerians as a new, digital way to invest. From Bitcoin to Ethereum, even to Tap Swap, we are increasingly turning to digital currencies as an alternative to traditional banking systems and financial markets.

In fact, Nigeria is now one of the largest markets for cryptocurrency in the world, with a significant portion of the population embracing this new form of investment.

Crypto as the New Ponzi?

While cryptocurrency offers real opportunities for financial growth, it also comes with risks, some of which parallel the dangers of Ponzi schemes.

The volatile nature of the crypto market means that prices can fluctuate dramatically, and while some investors have made fortunes, others have lost significant sums.

This volatility is similar to the highs and lows experienced by participants in Ponzi schemes, creating an interesting environment where people are mostly drawn in by the promise of quick returns.

Let’s not even talk about the fraudulent Initial Coin Offerings (ICOs) and how crypto scams in Nigeria have made a mess of the legitimacy of cryptocurrency as a whole.

Scammers have adapted their tactics, leveraging the appeal of digital currencies to defraud unsuspecting investors. In some cases, these schemes are no different from the Ponzi models of the past, using new buzzwords like “blockchain” and “crypto” to lure victims.

Tips for Investing in Cryptocurrency

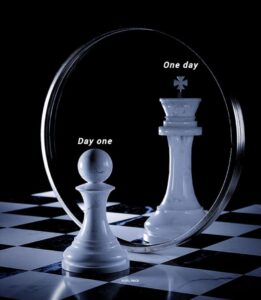

For anyone who is eager to explore cryptocurrency as a replacement for Ponzi schemes, it’s important to approach this financial terrain with caution.

While there are legitimate opportunities for profit, the risks are just as real, and an informed, strategic approach is essential. Here are tips that can help you stay afloat in the world of cryptocurrency

1. Educate Yourself: Understanding how cryptocurrencies work, the technology behind them, and the risks involved is the first step in making smart investment decisions. There are numerous free resources available to learn about blockchain technology, crypto trading, and investment strategies.

2. Start Small: Given the volatility of cryptocurrencies, it’s wise to start with a small investment that you can afford to lose. This minimizes potential losses while you familiarize yourself with the market.

3. Diversify: Just like in any investment, diversifying your crypto portfolio can help manage risk. Instead of putting all your funds into one currency, consider spreading your investments across multiple coins or tokens.

4. Be Aware of Scams: If an investment opportunity sounds too good to be true, it probably is. Be cautious of crypto schemes that promise guaranteed returns or ask for upfront payments. Always verify the legitimacy of platforms before investing.

5. Use Trusted Exchanges: Only trade on reputable and secure cryptocurrency exchanges to avoid falling victim to scams. Look for platforms with strong security measures and positive user reviews.

6. Stay Updated on Regulations: Our government has expressed mixed opinions on cryptocurrency, from initially restricting its use to considering regulations for the growing industry. Stay informed about legal developments that could impact your investments.

For Nigerians, the key to thriving in the world of cryptocurrency lies in making informed choices and avoiding get-rich-quick schemes.

Cypto enthusiasts can harness the potential of digital currencies without falling into the traps of the past by staying mindful of the lessons learned from Ponzi schemes.

For more tips on proper money management and investment opportunities, you should join our “Finance 101” community on Fusion.

2,538 Responses

https://nyupharm.com/# canadian pharmacy meds review

my canadian pharmacy rx legal canadian pharmacy online buy prescription drugs from canada cheap

https://unmpharm.com/# Unm Pharm

Umass India Pharm: legitimate online pharmacies india – Umass India Pharm

https://umassindiapharm.xyz/# Umass India Pharm

http://unmpharm.com/# Unm Pharm

best prices on finasteride in mexico п»їmexican pharmacy prescription drugs mexico pharmacy

Unm Pharm: buy viagra from mexican pharmacy – Unm Pharm

https://umassindiapharm.com/# Umass India Pharm

https://unmpharm.com/# Unm Pharm

http://unmpharm.com/# Unm Pharm

buy prescription drugs from india: Umass India Pharm – indian pharmacies safe

buy from mexico pharmacy: Unm Pharm – trusted mexico pharmacy with US shipping

http://nyupharm.com/# canadian pharmacy india

https://unmpharm.com/# legit mexico pharmacy shipping to USA

canadian pharmacy king: buy drugs from canada – canadian pharmacy oxycodone

https://nyupharm.xyz/# online canadian pharmacy

http://nyupharm.com/# safe online pharmacies in canada

indian pharmacy online: Umass India Pharm – india pharmacy

http://nyupharm.com/# canadian pharmacy world reviews

http://nyupharm.com/# cross border pharmacy canada

canadian pharmacies: canadian mail order pharmacy – reliable canadian pharmacy

http://nyupharm.com/# buy canadian drugs

https://unmpharm.xyz/# Unm Pharm

canadian pharmacies comparison: canadian pharmacy service – online canadian pharmacy

п»їlegitimate online pharmacies india Umass India Pharm reputable indian pharmacies

top 10 online pharmacy in india: online shopping pharmacy india – reputable indian online pharmacy

tadalafil mexico pharmacy: Unm Pharm – Unm Pharm

http://umassindiapharm.com/# Umass India Pharm

https://nyupharm.xyz/# buying drugs from canada

http://umassindiapharm.com/# top 10 pharmacies in india

canadian pharmacy 1 internet online drugstore: buy drugs from canada – vipps canadian pharmacy

canadapharmacyonline: canadian pharmacy 24h com safe – canadian pharmacy sarasota

https://umassindiapharm.xyz/# reputable indian online pharmacy

Unm Pharm: Unm Pharm – Unm Pharm

https://nyupharm.com/# canadian pharmacy victoza

https://nyupharm.xyz/# best canadian online pharmacy reviews

buy cialis from mexico: Unm Pharm – Unm Pharm