December is the month of Dettying with abandon, gifting people who won’t reciprocate, and spending your salary before it even hits your account. But let’s not forget that January, also known as “the 72-day month,” is lurking around the corner, ready to humble even the proudest spender.

So how do you navigate budgeting to survive the financial rollercoaster? Here’s a masterclass in stretching your December salary till February.

1. Turn “No” into Your Favorite Word

No, you can’t attend every owambe this month. No, you can’t buy that matching Christmas pajama set (alternatives dey). And no, you can’t dash your cousin money for their “business proposal” (aka betting app). “No” is the budgeter’s best friend. Practice saying it with your full chest; nobody will beat you!

2. Become a Professional Food Smuggler

Holiday season = free food season. Attend events with Tupperware (aka plastic takeaway) discreetly tucked into your handbag. You’re not just going to eat; you’re taking home tomorrow’s lunch and dinner. When your host says, “Take more jollof,” don’t be shy—secure the bag. Literally.

3. Ghost Your Friends (Temporarily, of Course)

Avoid friends who say things like:

- “Let’s hit the club tonight!”

- “It’s just one round of small chops; you can afford it.”

- “Don’t worry, we’ll split the bill.”

They’re financial red flags, and spending time with them will leave you drinking garri in January. Activate airplane mode and tell them you’ve gone for “personal development.”

4. Give Santa Claus the Day Off

Gifts? In this economy? Tell everyone you’re focusing on “the gift of presence” this year. Hand out handwritten notes with affirmations like, “You’re a star!” or “Your vibes are immaculate.” If anyone complains, remind them that Jesus didn’t have a gift registry.

5. Cook at Home (No, Really)

December has a way of making everyone forget their kitchen exists. Before you know it, you’ve spent your life savings on small chops and overpriced asun. Get reacquainted with your pots and pans—it’s cheaper, healthier, and you can still “spice things up” with Instagram-worthy plating.

6. Pretend January Doesn’t Exist

Here’s a sneaky psychological trick: Budget for January and February in December. That way, by the time January arrives with its disrespectful energy bills and back-to-school expenses, you’ll already be two steps ahead. The key is to treat January like it’s happening next week. (Spoiler: It basically is.)

7. Sell Things You Don’t Need

Do you really need five pairs of sneakers? Or that outfit you’ve only worn once because it itches? Turn your wardrobe into an ATM by selling unused items online. Bonus: You’ll feel less guilty splurging on small pleasures when you’re technically spending “free” money.

8. Learn the Art of Selective Fasting

Fasting isn’t just for spiritual growth—it’s a budgeting tool, too! Skip breakfast and call it intermittent fasting. Cut out dinner, and suddenly, you’re health-conscious and financially responsible. Who knew hunger could be so rewarding?

9. Normalize “I Don’t Have”

If someone asks you for money, practice saying, “I don’t have” with confidence. It doesn’t matter if they just saw you buy shawarma; this is your budgeting journey, not theirs. Even banks say “insufficient funds”—why can’t you?

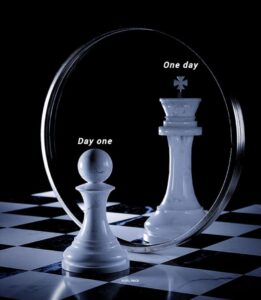

10. Create a Vision Board of Your January Struggles

Visualize yourself broke, eating okpa and regretting your life choices in January. Stick this image on your fridge as a reminder every time you’re tempted to “ball small.” Fear is a great motivator.

Budgeting isn’t about depriving yourself; it’s about making sure future you doesn’t hate current you. So, go ahead and enjoy the festive season—but remember, December shege lasts only a month, while January shege feels like an eternity. Plan wisely, and may your salary never run dry before February.

Join the Finance 101 community on Fusion for more financial advice, budgeting tips and investment opportunities.

324 Responses

Zusätzlich arbeitet das Casino mit Organisationen wie GamCare und Gamblers Anonymous zusammen und bietet Ressourcen und Unterstützung für Spieler, die Hilfe benötigen. Die Spielauswahl, Boni, Zahlungsoptionen und mobile Nutzererfahrung sind nur einige der Faktoren, die wir in diesem neuen Casino genau unter die Lupe nehmen. Die Bonusangebote und die große Spielauswahl haben mich sofort überzeugt.“ Der technische Support von Legiano ist rund um die Uhr erreichbar und bietet schnelle Hilfe bei allen Anfragen. Für Wettliebhaber hält Legiano eine umfangreiche Sportwetten-Plattform bereit. Darüber hinaus bietet die Plattform regelmäßig Reload-Boni und Cashback-Aktionen, um auch treue Spieler kontinuierlich zu belohnen.

Nicht nur der Willkommensbonus überzeugt, sondern auch die riesige Spielauswahl mit mehr als 9.000 unterschiedlichen Spielen. Sollten Sie regelmäßig spielen, haben Sie somit die Chance auf exklusive Bonusangebote und vieles mehr. Mit Ihrer Registrierung erhalten Sie Zugriff auf mehr als 9.000 Casinospiele und tolle Bonusangebote. Nach meiner Legiano Casino Bewertung wird insgesamt sichergestellt, dass Sie in dem Online-Casino für Österreich legal und sicher spielen können.

References:

https://online-spielhallen.de/monro-casino-test-erfahrungen-fur-deutsche-spieler/

eldorado casino shreveport

References:

https://odvinsk.ru/user/sharonshears3/

roulette casino

References:

https://king-bookmark.stream/story.php?title=oneida-nation-to-open-50m-hotel-casino-expansion-in-ny

mail slot cover

References:

https://www.google.fm/url?q=https://telegra.ph/Top-10-Online-Casinos-in-Australia-Trusted-and-Secure-Platforms-11-27

pokies online

References:

http://www.pshunv.com/space-uid-130938.html

slot casino

References:

https://www.google.com.ag/url?q=https://www.blurb.com/user/heightgame72

Appreciation to my father who told me about this website,

this weblog is genuinely remarkable. https://www.highlandguides.com vpn

Auch das Live Casino von Boomerang hat viel zu bieten. 5.000+ Spielautomaten, Live-Spiele, Jackpots, Tischspiele und mehr Hier erwartet Sie eine riesige Auswahl an Spielen und ein großzügiger Neukundenbonus.

Wählen Sie Ihr geliebtes Spiel und erhalten Sie ein aufregendes Spielerlebnis! Im Bereich „Tischspiele” können Sie die digitalen Versionen von Roulette und die traditionellen Kartenspiele genießen, die sich durch originelle Spielabläufe und farbenfrohe Designs auszeichnen. Als vollwertige Webressource bietet es die gesamte Palette der Spiele, die Sie in der Desktop-Version finden können.

Folgen Sie nun einfach den angezeigten Schritten, um die Einzahlung abzuschließen. Dadurch können Sie Ihre Lieblingsspiele noch einmal aus einer neuen Perspektive erleben. Dadurch kannst du auch ohne echten Dealer sicher sein, dass keine Manipulation stattfindet. Beliebte Tischspiele sind Blackjack, Baccarat, Poker und Roulette. Zahlreiche klassische Kartenspiele wie Blackjack, Baccarat und Poker stehen zur Verfügung. Mit echten Dealern und einer qualitativ hochwertigen Übertragung sind Sie hier live dabei.

References:

https://online-spielhallen.de/lex-casino-auszahlung-ein-umfassender-leitfaden-fur-reibungslose-gewinnauszahlungen/

https://t.me/s/kazino_s_minimalnym_depozitom/4

From personal experience, this impressive variety ensures something for everyone. Additionally, the platform may request verification of your chosen payment method. Choose the one that catches your eye the most and fund your account to dive into the action. Licensing details, as expected, are also clearly displayed here. The footer includes links to vital resources such as Terms & Conditions, payment information, and organizations offering support for responsible gambling. Pages and tabs load quickly, ensuring a seamless browsing experience, and the straightforward navigation enhances overall usability.

Claim special mobile-only promotions such as free spins and cashback rewards. Enjoy fast deposits and withdrawals via Visa, Mastercard, e-wallets, and cryptocurrency. Once the game is fixed, you will be notified. To be notified when your game is ready, please leave your email below.

Elevate your gaming experience with SkyCrown Casino, your premier destination for sports betting, casino games, and live dealer action. Players can access a wide variety of games, including slots, table games, and live dealer options, all optimized for mobile play. The platform boasts high-quality graphics, a vast game library, and reliable customer support, making it an attractive option for both novice and experienced players. Whether you’re spinning the reels on a slot game or testing your skills at table games, these bonuses add value to your gaming experience. SkyCrown Casino offers various promotions to enhance the online gaming experience, and one of the most sought-after types of promotions are the SkyCrown Casino no deposit bonus codes. To claim the SkyCrown Casino no deposit bonus, players first need to sign up for an account at the casino.

References:

https://blackcoin.co/fairgo-no-deposit-bonuses-in-australia-a-comprehensive-guide/

The Star Casino is known for offering a variety of bonuses and promotions to its visitors, aiming to enhance their gaming experience and provide additional value. Each gaming option at Star Casino Sydney is designed to cater to various interests and skill levels, ensuring that all visitors have a memorable and enjoyable experience. The casino offers traditional baccarat along with popular variations that can include side bets or slightly altered rules to add an extra layer of excitement to the game. The simplicity of betting on colors, numbers, or ranges of numbers makes roulette accessible and thrilling for every casino visitor. The inclusion of these diverse versions aims to cater to all levels of blackjack enthusiasts, from novices to seasoned strategists, ensuring a dynamic and engaging gaming experience.

Imagine walking through the bustling gaming floor filled with the sounds of excitement and cheers from players. You can earn points by eating out, staying over, or playing games. The casino checks status credits every six months. From my tour of the casino, the minimum betting amount is AU$20. Yes, the games at Crown Sydney are in great condition.

Well located in the centre of Sydney, Tequila Sunrise Hostel Sydney is within 800 metres of Central Station Sydney and less than 1 km of International Convention Centre Sydney. Right in the centre of Sydney, set within a short distance of International Convention Centre Sydney and Central Station Sydney, MetaWise 1Bed Next to ICC Darling Harbour 154 offers free WiFi, air… Facing the beachfront, Peppers Manly Beach offers 4-star accommodation in Sydney and features an outdoor swimming pool, garden and BBQ facilities. Overlooking Sydney Harbour, Four Seasons Hotel Sydney offers complimentary Premium WiFi, a bar, restaurant, fitness centre and swimming pool. Featuring a casino, a day spa and 20 bars and restaurants, The Darling at The Star is just 650 metres from Cockle Bay.

References:

https://blackcoin.co/best-live-dealer-online-casinos-in-australia/

casino online paypal

References:

https://hifrequency.live/community/profile/shirleenpietrza/

online real casino paypal

References:

https://rsh-recruitment.nl/employer/best-real-money-online-pokies-in-australia-for-december-2025/

Off The Burner 12.6.23 This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Gates of Olympus is a fairly straightforward slot in terms of gameplay. Although you can earn wins by matching groups of symbols, everything is geared up towards a single bonus game, which we’ll discuss shortly. The only other game mechanics of note are the Tumble feature and the Multipliers. Test-drive Gates of Olympus 1000 with a free demo. You’ll get unlimited virtual credits to explore all features without risking real money. Up against reels of precious gems and mysterious artifacts, players will face a trial to enter the heavenly kingdom. The violet sky seems temptingly just beyond the gates.

http://www.ohlor.com/bizzo-casino-in-australia-a-players-insight/

Costa leans contemporary and a little restrained. Neutral tones, clean lines, not a lot of theatrical flourish. The menus follow the same logic, focused on craft coffees, pastries, and the occasional seasonal twist like the 2023 Honeycomb Cappuccino. There is no reference to gates of olympus in online menu promotions, decor, or entertainment. Instead, Costa trades on familiarity and that easy, modern comfort. Background music stays light. Gates of Olympus is a high variance slot and features colourful symbols. For instance, blue, green, yellow, purple, and red gemstones make up the low-paying icons. The red ruby can award up to 10x your bet if you land 12+ in a single spin. For those who love gaming on the go (like me during my lunch breaks), Gates of Olympus is fully optimized for mobile play. Whether you’re using a smartphone or tablet, the game runs smoothly without sacrificing any of its visual or audio quality. It’s perfect for when you need a quick escape to the divine realms.

They offer a free bet of US$$100 to customers in case of at least 20 consecutive unsuccessful bets, mitigating potential losses to some extent. “Cups” and other regularly held promotions offer free bets to those who place a specific number of bets within a certain period of time. Gates of Olympus is a product of Pragmatic Play, a leading game provider recognized for its extensive portfolio of over 100 high-quality online casino games. Pragmatic Play’s games are enjoyed in over 80 countries and have garnered industry awards, reflecting their commitment to excellence and player satisfaction. Their games are designed for instant play, requiring no downloads. To enjoy Gates of Olympus, simply launch the game directly within your 1xbet account or preferred online casino platform. Match 8-30 symbols anywhere on the grid to win. Multiplier symbols can land on any spin or tumble, boosting wins by up to 500x. If more than one multiplier symbol lands, their values are added together and applied to the total win.

https://exam.ecic.edu.pk/betmgm-online-casino-review-for-australian-players/

304 Buitenkloof Studios, Cape Town, 8001, South Africa Test-drive Gates of Olympus 1000 with a free demo. You’ll get unlimited virtual credits to explore all features without risking real money. Gates of Olympus Super Scatter Land four or more scatter symbols to trigger the bonus game with 15 free spins. Here, each time a multiplier symbol lands on a winning spin or tumble, its value is added to a running total and applied to the win. In the growing domain of online casino games, Gates of Olympus slot has emerged as a notable contender, offering players a transcendent journey through the mythical realms of ancient Greek deities. This digital adventure, curated by Pragmatic Play, intertwines the allure of potential fortune with the enchanting narratives of ancient mythology, creating a gaming experience that is both visually and financially compelling.

COPYRIGHT © 2015 – 2025. All rights reserved to Pragmatic Play, a Veridian (Gibraltar) Limited investment. Any and all content included on this website or incorporated by reference is protected by international copyright laws. Go on a legendary adventure on all of your favourite iOS and Android devices as Gates of Olympus is fully compatible on all mobile devices. Play in seamless portrait or landscape mode with all features stayin gon-screen at all times including the paytable, bet levels, and all-important spin button. COPYRIGHT © 2015 – 2025. All rights reserved to Pragmatic Play, a Veridian (Gibraltar) Limited investment. Any and all content included on this website or incorporated by reference is protected by international copyright laws. Go on a legendary adventure on all of your favourite iOS and Android devices as Gates of Olympus is fully compatible on all mobile devices. Play in seamless portrait or landscape mode with all features stayin gon-screen at all times including the paytable, bet levels, and all-important spin button.

https://www.rank-consultancy.com/uptown-casino-game-review-a-must-try-for-australian-players/

Gates of Olympus comes with a Return to Player (RTP) percentage of 96.5%, which is above average for online slots. This means that for every $100 wagered, on average, players can expect to receive $96.50 back over the long term. Set on a familiar 6×5 grid where the Greek God resides to the right of the reels, players must match at least eight snowy symbols, including crowns, hourglasses and gems, to secure a merry win. Let us remind you that the slot was released with a matrix configuration of 6 reels and 5 rows. You can play it with a bet value ranging from 0,20 to 100 credits per spin, collecting clusters on 20 win lines. Also, don’t miss the opportunity to activate free spins and take advantage of random multipliers up to x500. Lower-paying symbols are blue, green, yellow, purple and red precious stones, while the higher-paying symbols are a cup, a ring, an hourglass, and a crown. Scatter wins of 8-9 OAK are worth 0.25x to 10x, or get lucky and hit 12+ of a kind to win 2 to 50 times the bet. Substitutions do not occur in this game since Gates of Olympus Super Scatter does not have wild symbols on any of its reels. As before, the game utilises a tumble mechanic, which means that when a win hits, the winning symbols disappear, and new ones fall in from above. This continues as long as new wins keep landing.

Developed by a renowned gaming studio, Vortex 9 is available on multiple platforms, including mobile devices and browsers. The game falls under the action genre and has received high ratings from players for its engaging gameplay and stunning graphics. With options for both casual and competitive play, Vortex 9 is designed to cater to a wide audience. The game is free to play, ensuring that anyone can join in on the excitement without the need for registration, allowing for instant play. How to Play: To play Vortex 9 online, simply visit . This platform provides a lag-free, low-latency gaming experience, allowing players to dive into the action without the need for downloads or installations. With the ability to play directly in your browser, you can enjoy Vortex 9 anywhere, anytime. The convenience of now.gg means you can join your friends in epic battles while maintaining a smooth and enjoyable gaming experience.

https://simaalborg.dk/bigger-bass-bonanza-review-a-top-slot-choice-for-uk-players/

The Rainbow Six Siege Marketplace is where you need to go whether you’re looking to exchange some unwanted items for R6S credits or get that elusive weapon skin from a few seasons back. G-Vortex Game Space APK is a potential application to improve mobile gaming performance. By using optimization features and options, users can get the most out of the app’s features and enjoy the game in a smoother and more enjoyable way. Vortex Cloud Gaming APK for Android is a program for Android which fall in Utilities category and developed by RemoteMyApp. This app is one of the most popular app among it’s users due to certain reasons.You can also explore other software’s available on Filerox in Utilities category. In this article I will going to pr… Read More. Wild Area 2025 will also see Shiny Hatenna debut in the popular mobile game, being implemented as a wild encounter. Pokemon GO players can also expect two rotating spawn hours featuring different mons. The first of those sounds like something from Persona 3, being called the Lurking Dark Hour, featuring spawn such as Alolan Meowth and Grimer, Gastly, Seedot, Skorupi, Stunky, and over a dozen other pocket monsters. Fanciful Fairy Hour will follow with increased spawn chances for Clefairy, Alolan Vulpix, Jigglypuff, Galarian Ponyta, Marill, Ralts, and many other Fairy-type mons.

WhatsApp web’ https://www.ws-cqy-whatsapp.com WhatsApp Web provides a clear overview of ongoing conversations. . Date: 2026-01-16 07:39:52 (-03).

Se disabiliti questo cookie, non saremo in grado di salvare le tue preferenze. Ciò significa che ogni volta che visiti questo sito web dovrai abilitare o disabilitare nuovamente i cookie. Je suis totalement conquis par BetFury Casino, il offre une aventure pleine de frissons. La selection de jeux est phenomenale, offrant des sessions de casino en direct immersives. Le service d’assistance est irreprochable, offrant des reponses claires et rapides. Les transactions en cryptomonnaies comme Bitcoin ou Ethereum sont ultra-rapides, parfois les offres comme le pack de bienvenue de 590 % pourraient etre plus accessibles. En resume, BetFury Casino vaut pleinement le detour pour les joueurs en quete de sensations fortes ! Notons egalement que l’interface est fluide et intuitive, facilite chaque session.

https://www.hoaxbuster.com/redacteur/remagmado1973

pt.casino.guru jogar-slot-gates-of-olympus-gratuitamente Le migliori slot online a pagamento, quando scelte con criterio, possono offrire un’esperienza di gioco coinvolgente, purché non si parta con l’aspettativa di fare il “colpo della vita”. Il segreto non è tanto trovare quella che paga di più, ma quella che si adatta meglio al tuo stile: c’è chi preferisce le slot machine con volatilità bassa, chi punta tutto sui jackpot, chi cerca solo i free spin. Eurobet è un altro sito ADM con un numero di slot davvero ampio, con oltre 3.000 titoli. Nel casinò è possibile filtrare le slot premium, novità, jackpot, provider, oltreché trovare una sezione dedicata alle scommesse sportive e altre ad altre categorie, come il bingo online.

constantly i used to read smaller articles which also clear their motive,

and that is also happening with this article which I am reading here.

Take a look at my web blog; ORGY PORN VIDEOS

В джунглях азарта, где каждый ресурс стремится привлечь обещаниями быстрых выигрышей, рейтинг новых онлайн казино

является той самой картой, что ведет через дебри подвохов. Для профи и начинающих, что пресытился от фальшивых обещаний, такой средство, чтобы увидеть реальную выплату, будто вес ценной фишки на пальцах. Без пустой воды, просто проверенные сайты, в которых rtp не лишь цифра, но реальная везение.Составлено из гугловых поисков, будто ловушка, что ловит наиболее свежие веяния по рунете. Тут минуя места к шаблонных трюков, всякий пункт словно ход на покере, где блеф раскрывается сразу. Игроки понимают: по рунете тон письма на сарказмом, где ирония скрывается словно совет, помогает миновать ловушек.На https://www.don8play.ru такой рейтинг находится как готовая карта, подготовленный на раздаче. Посмотри, если нужно ощутить ритм подлинной ставки, без обмана плюс неудач. Тем кто знает тактильность выигрыша, он будто взять фишки в руках, минуя глядеть на дисплей.

Hello there! I know this is kinda off topic however , I’d figured I’d ask.

Would you be interested in exchanging links or maybe guest

writing a blog post or vice-versa? My website covers a lot of the same subjects as

yours and I think we could greatly benefit from each other.

If you are interested feel free to send me an email.

I look forward to hearing from you! Superb blog by the way!

katana

Online Casino Australia Real Money Feel Unstoppable Tonight