With sapa knocking aggressively on doors and the economy throwing surprises like a Nollywood plot twist, the idea of risking hard-earned money on stocks, bonds, or real estate seems daunting. But here’s the truth: if done right, investments can be the bailout package you didn’t know you needed.

The good news is that investments are no longer the exclusive playground of oil magnates and business moguls.

Thanks to technology and financial innovation, young Nigerians can now play the game without breaking the bank.

Here’s a step-by-step guide to demystify investments and help you start your journey with confidence.

Know Your ‘Why’

Before anything else, ask yourself: why are you investing? Is it to buy land in Lekki, pay for your babe’s dream wedding, or secure a rainy-day fund?

Understanding your goals will determine where and how you invest. As we say in Naija, “If you no sabi where you dey go, everywhere go resemble road.”

For short-term goals, consider low-risk options like fixed-income securities. For long-term goals, explore higher-risk opportunities such as stocks or mutual funds.

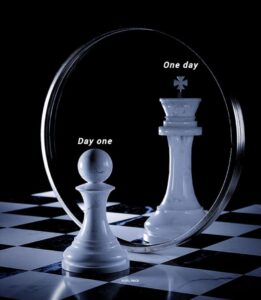

Start Small, Think Big

Many young Nigerians mistakenly believe they need millions to start investing. Not true!

Platforms like Bamboo, Rise, and Doubble now allow you to invest with as little as ₦1,000. Think of it as buying drinks at a club—start small but aim for bigger in the future.

Remember, consistency is key. Even small contributions, when done regularly, can grow into significant wealth. After all, little drops of water everyday make…

Educate Yourself

In the world of investments, ignorance is premium risk. Take time to understand the basics: what are stocks, bonds, ETFs, and real estate?

Follow financial influencers (the credible ones, not Yahoo Yahoo advisers) and read up on trusted platforms like Business Day and Bloomberg.

Avoid investment schemes that promise returns that sound too good to be true. Remember MMM? “Shine your eye well-well”—don’t let greed override common sense.

Diversify: Don’t Put All Your Eggs in One Basket

Diversification is the golden rule of investing. Spread your money across different asset classes to reduce risk. For example:

- Invest in stocks for growth.

- Put some money in real estate for stability.

- Consider mutual funds for professional management.

Just like Nigerian jollof, a good investment portfolio has a mix of ingredients that balance flavor and spice.

Leverage Technology

Young Nigerians are tech-savvy, so why not use that to your advantage?

Investment apps like Chaka and PiggyVest simplify the process, offering tools to monitor your portfolio and automate savings.

Many apps even offer beginner-friendly resources to guide you along the way.

So why stress yourself when you can leverage technology.

Stay Patient

Investing is not a get-rich-quick scheme. It takes time for your money to grow, just like it takes time for beans to get done.

Resist the urge to panic during market downturns; ups and downs are normal.

Stay focused on your long-term goals and let compound interest work its magic.

Understand Your Risk Tolerance

Are you the type to shout “Blood of Jesus!” at the sight of small financial loss, or can you handle market volatility like a seasoned Lagos danfo conductor?

Your risk tolerance will determine the type of investments you should pursue.

Stocks and cryptocurrencies offer higher returns but come with greater risk. Bonds and fixed deposits, on the other hand, are safer but less lucrative.

Seek Professional Advice: No Be Everything You Fit Do Yourself

It’s okay to admit you don’t know it all. Consult a financial advisor or wealth manager to help you navigate complex investments.

Think of them as your personal Baba Ijebu, only in this case they would be giving you the numbers that actually work.

Watch Out for Wahala Tax

Understand the impact of fees and taxes on your investments.

Whether it’s charges for managing your portfolio or capital gains tax, these small deductions can add up over time.

Always read the fine print—don’t let hidden charges chop your money like suya.

Keep Learning and Adapting

The investment landscape is always changing, and staying informed is key to staying ahead.

Attend webinars, join investment communities, and subscribe to financial newsletters.

In this game, “knowledge is not just power, it is money too.”

Investing might seem intimidating at first, but taking the first step is the most important part.

In a country where sapa trends every January and inflation threatens to turn ₦1,000 into small puff-puff, investing is one way to secure your financial future.

So, dear young Nigerian, the next time you’re tempted to spend your last ₦5,000 on shawarma, think about how that same amount could grow in the stock market.

Start small, stay consistent, and remember: “Na person wey hustle today go soft tomorrow.”

Join me on Finance 101 community on Fusion and let’s step things up this year

3,887 Responses

comprare medicinali online legali: differenza tra Spedra e Viagra – Spedra

https://vitalpharma24.shop/# diskrete Lieferung per DHL

Spedra prezzo basso Italia: FarmaciaViva – pillole per disfunzione erettile

Kamagra 100mg prix France: Sildenafil générique – kamagra oral jelly

comprare medicinali online legali: Spedra – Spedra

VitaHomme: Kamagra 100mg prix France – Kamagra pas cher France

Kamagra sans ordonnance: Kamagra oral jelly France – Vita Homme

http://vitahomme.com/# Vita Homme

https://mannvital.shop/# billig Viagra Norge

Kamagra livraison rapide en France: Vita Homme – Sildenafil générique

comprare medicinali online legali: Spedra prezzo basso Italia – Avanafil senza ricetta

Erfahrungen mit Kamagra 100mg: vital pharma 24 – diskrete Lieferung per DHL

Kamagra Oral Jelly Deutschland: Kamagra Oral Jelly Deutschland – Kamagra Oral Jelly Deutschland

trusted online pharmacy Ireland

trusted online pharmacy Ireland: best Irish pharmacy websites – online pharmacy

Australian pharmacy reviews [url=http://aussiemedshubau.com/#]AussieMedsHubAu[/url] best Australian pharmacies

AussieMedsHubAu [url=https://aussiemedshubau.com/#]cheap medicines online Australia[/url] Aussie Meds Hub

UkMedsGuide: UK online pharmacies list – online pharmacy

irishpharmafinder: online pharmacy – top-rated pharmacies in Ireland

pharmacy delivery Ireland

affordable medication Ireland

affordable medication Ireland

online pharmacy: best UK pharmacy websites – UkMedsGuide

http://ukmedsguide.com/# safe place to order meds UK

https://ukmedsguide.shop/# legitimate pharmacy sites UK

irishpharmafinder: pharmacy delivery Ireland – Irish online pharmacy reviews

buy medications online safely [url=http://safemedsguide.com/#]SafeMedsGuide[/url] buy medications online safely

pharmacy delivery Ireland

trusted online pharmacy Ireland

online pharmacy: online pharmacy – UK online pharmacies list

discount pharmacies in Ireland

https://irishpharmafinder.shop/# Irish online pharmacy reviews

online pharmacy reviews and ratings: trusted online pharmacy USA – top rated online pharmacies

buy medications online safely: Safe Meds Guide – online pharmacy reviews and ratings

Aussie Meds Hub Australia [url=https://aussiemedshubau.shop/#]Aussie Meds Hub[/url] cheap medicines online Australia

AussieMedsHubAu: Aussie Meds Hub – verified online chemists in Australia

verified online chemists in Australia: Aussie Meds Hub Australia – verified pharmacy coupon sites Australia

pharmacy delivery Ireland

irishpharmafinder

http://ukmedsguide.com/# UK online pharmacies list

affordable medication Ireland

affordable medications UK: online pharmacy – legitimate pharmacy sites UK

online pharmacy [url=https://irishpharmafinder.shop/#]trusted online pharmacy Ireland[/url] irishpharmafinder

Safe Meds Guide [url=https://safemedsguide.com/#]SafeMedsGuide[/url] online pharmacy reviews and ratings

buy medicine online legally Ireland: trusted online pharmacy Ireland – discount pharmacies in Ireland

buy medicine online legally Ireland

discount pharmacies in Ireland

discount pharmacies in Ireland

best UK pharmacy websites: cheap medicines online UK – legitimate pharmacy sites UK

http://irishpharmafinder.com/# discount pharmacies in Ireland