We all have that one thing that we think about whenever money enters our account. For some, it’s ice cream, cake, or suya. For others, it’s books with fancy covers or a perfume collection that screams big money spender.

In this article, we spoke to a few Nigerian workers residing in Lagos State about their guilty pleasures, and they all have something that they love but their bank account hates.

Let’s get right into it.

The Foodies

The foodies have their guilty pleasure built on the foundation of enjoyment.

For Yetunde, it’s an immense amount of love for party jollof, small chops, and occasional ice cream. And for Seyi, it’s a never-failing urge to buy Nutella every time she goes shopping. For Vivian, that urge is for McVities Shortbread and Chupa Chups Belts.

Jumoke spoils herself with suya and wine every now and then. And guess what? She also can’t stop herself from buying gifts for her friends. For MaryAnn and James, it is soft drinks and junk food. Their Chowdeck app hates to see them coming.😭

God abeg! Enjoyment is not supposed to come with guilt o. Me, I won’t lie, I fall into this category, and I know you do too 😏. How? Because who doesn’t like enjoyment?

If you fall into this category, here’s a way of making your enjoyment a little less guilty: anytime you buy that food, snack, or ice cream, put N1,000 or more into your investment on Fusion via Bamboo and watch your money grow like grass.

ALSO READ: NYSC Corper on How She Started a Controversial Alcohol Business Up North.

The Fashionistas

Never to be caught unfresh is the motto here. Their guilty pleasure is fashion. Buying clothes and shoes regularly is their forte. According to Amaka, looking good is too important; that’s why shoes and clothes are her guilty pleasures.

Well, I can’t help but agree. Fashion stays physically longer than the other guilty pleasures on the list, and your packaging gets better one cloth at a time. Not to mention you’re one of the few people making the world a better-dressed place.

If this is your group, sit down and add up all the money you’ve spent on clothes that you wore only once or haven’t worn at all, and then you’ll see you’re heading into a financial crisis. Take a step back, look at your wardrobe or box, put your hand on your chest, and say “E Don Do!”

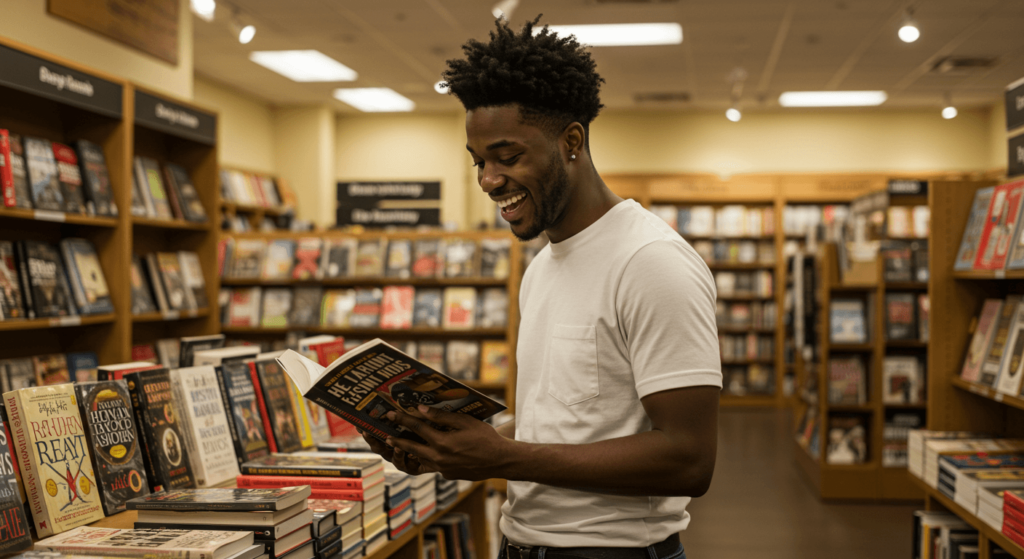

The Bookworms

Well, books are also cravings. But unlike snacks, it doesn’t go to your stomach but to your mind. And for bookworms like Ebiware, buying books is that guilty pleasure that eats up his money.

A book here, a book there, and the next thing you know, your monthly spend on books is higher than what you budgeted for feeding. Don’t worry, at the end of the month, E go shock you.

If you’re a book lover like Ebiware, a helpful tip to keep your passion alive without going broke is to consider joining a book reading community on Fusion, where you can exchange or borrow books from fellow members, or just start reading digital copies of the books you love.

ALSO READ: Personal Finance Tips – How To Stay Afloat in These Hard Times

The Perfume Collectors/ Frag Heads

Omo! Smelling good is never a bad thing. I’ll give this one a thumbs up as far as it isn’t costing you too much. Before Eau de Perfume turns into Eau de Sapa.

Mathias and Tola’s guilty pleasure comes from buying fragrances and scents. But one reason they’re beginning to feel guilty about this pleasure is because of their bank account. Their finances cry out for mercy every time they add a new perfume to their collection.

If you find yourself in this group, you can consider buying your scents when there’s a seasonal discount, and also remember to learn to say no to your Nose.

The No Guilty Pleasure Geng

These are the rugged and dogged budgeters. As one of the “No Guilty Pleasure” members, Timi said, “I need to make more money to confirm if such habits exist”. Hard guy, he still hasn’t found his guilty pleasure yet, but let’s give him some time 😏.

According to Tega, he doesn’t have any guilty pleasures, but data subscriptions these days have started looking like a guilty pleasure. Deep sigh! We all can relate to that. MTN, Glo, and Airtel, please pity us.

At the end of the day, guilty pleasures make life a bit sweeter. And that’s why food is the top ranking on this list. All work and no chop makes you a dull person.

ALSO READ: Financial Tips: How to Save Money for Your Dream Car in Lagos

Are you among the foodies, fashionistas, frag heads, or bookworms? If yes, make sure to follow our tips to make your pleasure a little less guilty. And if you’re part of the “No Guilty Pleasure Geng”, well done!

If the group you fall into is not on this list, what are your guilty pleasures?

Tell us in the Finance 101 community where we laugh together, relate, and share the best ways to grow and spend our hard-earned money.

3,173 Responses

Pin-Up AZ ölkəmizdə ən populyar platformadır. Burada minlərlə oyun və Aviator var. Pulu kartınıza anında köçürürlər. Mobil tətbiqi də var, telefondan oynamaq çox rahatdır. Giriş linki https://pinupaz.jp.net/# Pin Up rəsmi sayt tövsiyə edirəm.

Bu sene popüler olan casino siteleri hangileri? Cevabı web sitemizde mevcuttur. Deneme bonusu veren siteleri ve güncel giriş linklerini paylaşıyoruz. İncelemek için kaçak bahis siteleri kazanmaya başlayın.

2026 yılında en çok kazandıran casino siteleri hangileri? Detaylı liste platformumuzda mevcuttur. Bedava bahis veren siteleri ve yeni adres linklerini paylaşıyoruz. Hemen tıklayın türkçe casino siteleri fırsatı kaçırmayın.

To be honest, Just now found the best website for affordable pills. For those looking for medicines from India without prescription, IndiaPharm is highly recommended. It has fast shipping guaranteed. Visit here: cheap indian generics. Hope it helps.

Hey guys, I just came across a useful online drugstore for affordable pills. If you want to buy medicines from India cheaply, this site is the best place. They offer secure delivery to USA. More info here: check availability. Hope it helps.

This really answered my problem, thank you!

Hey guys, Just now came across a useful online drugstore for cheap meds. If you want to buy generic pills safely, this site is the best place. It has wholesale rates guaranteed. Take a look: cheap indian generics. Cheers.

Hello, I just discovered the best Indian pharmacy for affordable pills. For those looking for cheap antibiotics safely, this store is very reliable. You get lowest prices guaranteed. Take a look: IndiaPharm. Best regards.

Hey guys, I recently stumbled upon a great website to buy generics. If you want to buy generic pills cheaply, this store is highly recommended. They offer secure delivery to USA. Visit here: indian pharmacy online. Best regards.

Hello, I recently stumbled upon a great source from India to save on Rx. If you want to buy medicines from India at factory prices, this store is highly recommended. They offer lowest prices guaranteed. Take a look: indian pharmacy. Cheers.

To be honest, I recently found a trusted website for cheap meds. For those seeking and need cheap antibiotics, this store is highly recommended. Fast shipping and very reliable. Visit here: https://pharm.mex.com/#. Take care.

Hey there, I recently came across an awesome online source for affordable pills. For those seeking and want affordable prescriptions, this store is the best option. No prescription needed plus very reliable. Link is here: cheap antibiotics mexico. Good luck with everything.

Hey there, I recently ran into an awesome website for affordable pills. For those seeking and need affordable prescriptions, this site is the best option. Great prices plus it is safe. Take a look: Pharm Mex. Cheers.

Hey guys, I recently discovered a useful Indian pharmacy for cheap meds. If you need cheap antibiotics at factory prices, this store is very reliable. It has fast shipping to USA. More info here: https://indiapharm.in.net/#. Good luck.

Greetings, I just ran into an awesome resource to save on Rx. If you want to save money and need meds from Mexico, Pharm Mex is a game changer. Great prices plus it is safe. Visit here: https://pharm.mex.com/#. Many thanks.

Hi all, I recently came across a useful online drugstore for cheap meds. For those looking for generic pills cheaply, this site is the best place. You get fast shipping to USA. More info here: https://indiapharm.in.net/#. Good luck.

Hello, I recently came across a useful Indian pharmacy for affordable pills. If you need cheap antibiotics at factory prices, IndiaPharm is worth checking. You get secure delivery guaranteed. Visit here: cheap indian generics. Best regards.

To be honest, Lately found a great source from India for cheap meds. For those looking for generic pills without prescription, this store is worth checking. You get secure delivery to USA. Check it out: IndiaPharm. Cheers.

Our precipitation is ambivalent about gravity.

Greetings, I recently found a trusted online source for cheap meds. If you are tired of high prices and need generic drugs, this store is worth checking out. They ship to USA and secure. Visit here: check availability. Have a nice day.

Hi all, Lately stumbled upon an amazing Indian pharmacy for affordable pills. For those looking for cheap antibiotics at factory prices, IndiaPharm is highly recommended. It has lowest prices guaranteed. Check it out: https://indiapharm.in.net/#. Cheers.

Hello, Just now came across a useful website for cheap meds. If you need ED meds cheaply, IndiaPharm is highly recommended. It has lowest prices worldwide. More info here: https://indiapharm.in.net/#. Good luck.

Greetings, I recently found the best website to save on Rx. If you need medicines from India at factory prices, this store is worth checking. It has secure delivery worldwide. Check it out: https://indiapharm.in.net/#. Best regards.