Your 20s and 30s is the era where you finally escape the “broke student” label to being a “broke adult”, because what is adulthood if not paying bills on repeat and there is never enough money.

You get your first real paycheck and believe you can now buy whatever you want, after all another one will come in by the end of the next month. Nobody warned you that the only thing you will get to buy for yourself is a box of pizza, and maybe one drink.

The truth is, while you’re out here chasing “soft life” and trying to figure things out, there are tiny little habits that seem harmless now but can wreck your future.

So, before you spend your salary on another gadget you don’t need or start thinking YOLO is a financial plan, let’s talk about the most common money mistakes to avoid in your 20s and 30s and how not to let them ruin your future.

1. Spending Money Like You’re Beyonce (On a Fresh Graduate Salary!)

Congrats! You survived the job applications, the awkward interviews, and the “we’ll get back to you” emails that never came. Now, the paycheck has finally landed, it’s time to reward yourself, you deserve a staycation and brunch at a fine dining restaurant.

Just remember your bank account still thinks you’re on student allowance. That salary that feels like a fortune on payday can vanish very quickly if you are not careful.

Yes, budgeting is boring. But so is being “broke” two weeks into the month and surviving on garri and biscuits until the next payday. Budgeting doesn’t mean you can’t enjoy life, it just means future you won’t be mad at you for financial recklessness.

ALSO READ: Savings 101: 5 Nigerians talk about how they save money in Lagos

2. Ignoring An Emergency Fund

There’s really no need for an emergency fund, you can always call your aunt that lives in the UK anytime you need money urgently. Big Flex!

Except that your aunt will eventually get tired of attending to your every need, since you’re now an adult. Life has a way of throwing unexpected bills at you and there’s your boss telling you “we’re like family” and forgetting to pay salaries that month.

The unexpected bills don’t care if payday is two weeks away or if you just blew your last cash on a “treat yourself” weekend. Without an emergency fund, you’ll end up borrowing from friends or running to loan apps, and trust me, nothing humbles you faster than owing money for a problem you didn’t even see coming.

It’s advisable to build an emergency fund, even if it’s just enough to cover transport, and Indomie for three months, it’s better than nothing. So the next time life throws shade, you can throw money back at it.

3. Delaying Investing (Because You Think You’re Too Young And Don’t Have The Money)

You keep telling yourself you’ll start investing “when you earn more”, but every time you earn more, somehow your expenses magically level up too. You go from shawarma on Fridays to Chinese rice every other night, and suddenly “you’re too rich” for public transport. Next thing, the “extra” money is nowhere to be found.

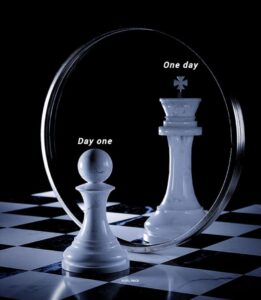

Truth is, if you don’t build the habit of investing when you have little, you probably won’t do it when you have plenty. Many young adults think investing is only for the wealthy and older people, or something to “figure out later.” But the earlier you start, the more compound interest works in your favor.

Start small. Even if it’s the cost of one shawarma a week, toss it into an investment account, preferably Bamboo on Fusion and earn in dollars. Don’t wait until you’re “a millionaire” to start, because by then, your taste for luxury will be wealthy too. Start now and in the future you will “thank you” for not procrastinating.

4. Overspending On Lifestyle Upgrades

Don’t you think you deserve a bigger space? It’s time to change your iPhone to the latest one. You just got a raise, so live like the “Odogwu and Odogwuress” that you are.

As your income grows, it’s tempting to upgrade your lifestyle. One small raise and suddenly your “manageable” one-room apartment feels like a shoebox, your perfectly fine car suddenly feels like a “keke.” Before you know it, every salary increase disappears into new bills, new habits, and new “standards” you suddenly can’t live without.

Lifestyle upgrade is the silent thief of wealth. On paper, you’re earning more. But in reality, you’re still living paycheck to paycheck, just with fancier clothes and maybe a nicer apartment.

When your income goes up, let your savings and investments go up too, not just your rent and shopping list. Fight the urge to spend every extra money. Grow your wealth now so you can actually enjoy real freedom later, not just the illusion of it. Because trust me, “rich broke” (earning plenty but still struggling) is a scam lifestyle you don’t want.

ALSO READ: The Hustler’s Guide to Saving Money in 2025

Your 20s and 30s are for building, not just careers and relationships, but also a solid financial foundation. Avoiding these money mistakes won’t make you rich overnight, but it will protect your future self from unnecessary struggles.

The choices you make with money today will tell a lot of difference in years to come. So, choose wisely, start early, and remember: every naira, dollar, or pound saved and invested today is buying you freedom tomorrow.

To learn more about how to manage and spend your money wisely, join the Finance 101 Community on Fusion.

294 Responses

Проблемы с авто? автоэлектрик фольксваген спб диагностика, ремонт электрооборудования, блоков управления, освещения и систем запуска. Опыт, современное оборудование и точное определение неисправностей.

Модульные дома https://modulndom.ru под ключ: быстрый монтаж, продуманные планировки и высокое качество сборки. Подходят для круглогодичного проживания, отличаются энергоэффективностью, надежностью и возможностью расширения.

Ahaa, its nice discussion about this post at this place at this weblog, I have read all that, so at this time me also commenting here.

лучшие химчистки обуви химчистка обуви в москве

Ahaa, its pleasant dialogue on the topic of this piece of writing here at this web site, I have read all that, so at this time me also commenting here.

Хотите знать, кому можно доверять в мире онлайн-казино? Наш справочник проводит независимую экспертизу: проверяем лицензии, процесс выплат и качество игр. Рейтинги объективны — мы не торгуем позициями. Принципы оценки открыты для всех. Подойдёт как новичкам, так и опытным игрокам. Следим за изменениями и регулярно обновляем информацию. Узнать о рейтингах казино

люстры светильники люстры подвесная деревянная

You’ve made some really good points there. I looked on the web to learn more about the issue and found most people will go along with your views on this site.

Лучшее казино up x играйте в слоты и live-казино без лишних сложностей. Простой вход, удобный интерфейс, стабильная платформа и широкий выбор игр для отдыха и развлечения.

Лучшее казино t.me играйте в слоты и live-казино без лишних сложностей. Простой вход, удобный интерфейс, стабильная платформа и широкий выбор игр для отдыха и развлечения.

Играешь в казино? up-x Слоты, рулетка, покер и live-дилеры, простой интерфейс, стабильная работа сайта и возможность играть онлайн без сложных настроек.

Лучшее казино ап икс скачать играйте в слоты и live-казино без лишних сложностей. Простой вход, удобный интерфейс, стабильная платформа и широкий выбор игр для отдыха и развлечения.

Today’s football match scores from around the world, comprehensive coverage of all leagues

Big chances created, high quality opportunities and their outcomes

**mitolyn official**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.

Нужна курсовая? купить курсовую Подготовка работ по заданию, методическим указаниям и теме преподавателя. Сроки, правки и сопровождение до сдачи включены.

Авиабилеты по низким ценам https://tutvot.com посуточная аренда квартир, вакансии без опыта работы и займы онлайн. Актуальные предложения, простой поиск и удобный выбор решений для путешествий, работы и финансов.

戏台在线免费在线观看,海外华人专属平台,高清无广告体验。

заклепка вытяжная 3 мм заклепка вытяжная глухая

У квартирі cleaninglviv.top часто замовляють

ДВС и КПП https://vavtomotor.ru автозапчасти для автомобилей с гарантией и проверенным состоянием. В наличии двигатели и коробки передач для популярных марок, подбор по VIN, быстрая доставка и выгодные цены.

Current Updates: http://www.scampatrol.org/tools/whois.php?domain=yourfreepoll.com

Лучшие и безопасные противопожарный резервуар для воды подземный эффективное решение для систем пожарной безопасности. Проектирование, производство и монтаж резервуаров для хранения воды в соответствии с требованиями нормативов.

Курсы по информатике ЕГЭ https://courses-ege.ru

Подземные резервуары для нефти https://underground-reservoirs.ru

Лучшее казино https://download-vavada.ru слоты, настольные игры и live-казино онлайн. Простая навигация, стабильная работа платформы и доступ к играм в любое время без установки дополнительных программ.

Играешь в казино? бонусы без депозита в казино бесплатные вращения в слотах, бонусы для новых игроков и действующие акции. Актуальные бонусы и предложения онлайн-казино.

горячие полотенцесушители купить полотенцесушитель

Фриспины бесплатно фриспины без депозита бесплатные вращения в онлайн-казино без пополнения счета. Актуальные предложения, условия получения и список казино с бонусами для новых игроков.

События в мире свежие новости события дня и аналитика. Актуальная информация о России и мире с постоянными обновлениями.

Тренды в строительстве заборов https://otoplenie-expert.com/stroitelstvo/trendy-v-stroitelstve-zaborov-dlya-dachi-v-2026-godu-sovety-po-vyboru-i-ustanovke.html для дачи в 2026 году: популярные материалы, современные конструкции и практичные решения. Советы по выбору забора и правильной установке с учетом бюджета и участка.

Отвод воды от фундамента https://totalarch.com/kak-pravilno-otvesti-vodu-ot-fundamenta-livnevka-svoimi-rukami-i-glavnye-zabluzhdeniya какие системы дренажа использовать, как правильно сделать отмостку и избежать подтопления. Пошаговые рекомендации для частного дома и дачи.

All-in-one platforms simplify management—when you buy tiktok views as part of comprehensive packages, you coordinate all growth metrics from one dashboard, saving time and reducing complexity in your social media strategy.

Халява в казино https://casino-bonus-bezdep.ru Бесплатные вращения в популярных слотах, актуальные акции и подробные условия использования.

I don’t even know how I ended up here, but I thought this post was good. I do not know who you are but certainly you’re going to a famous blogger if you are not already 😉 Cheers!

katana

I have been examinating out a few of your posts and i must say pretty good stuff. I will make sure to bookmark your website.

My relatives every time say that I am killing my time here at web, except I know I am getting knowledge all the time by reading such nice articles.

It’s genuinely very complex in this busy life to listen news on Television, so I only use the web for that purpose, and take the most up-to-date information.

шумоизоляция арок авто

I like reading through a post that will make people think. Also, many thanks for allowing me to comment!